CHARLOTTESVILLE PILOT ON-STREET PARKING PRICING

City of Charlottesville March 3, 2016

Nelson\Nygaard Consulting Associates Inc. | i

TABLE OF CONTENTS

Page

2015 Comprehensive Parking Study 7

Targeted Current Conditions 12

Evaluation of System Alternatives 19

Peer Profile: Roanoke, Virginia 27

Performance-Focused Enforcement 34

On-Street Parking Restriction Glossary 41

Downtown Utilization and Turnover Data Glossary 41

Parking Structure Utilization 44

TABLE OF FIGURES

Page

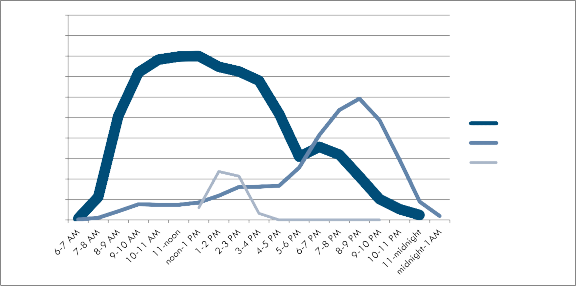

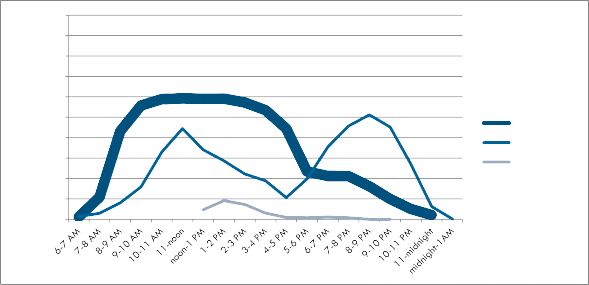

Figure 1 Weekday Downtown Parking Demand, April 2015 10

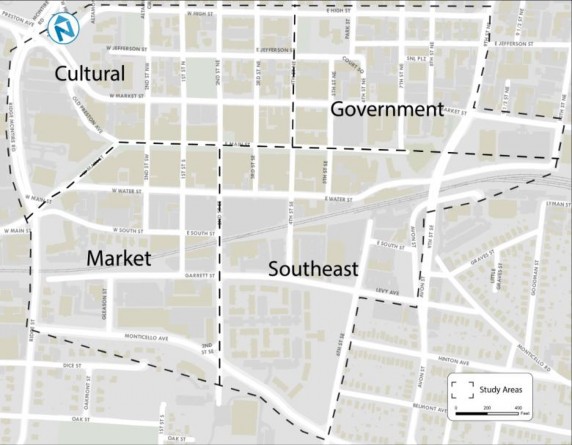

Figure 2 Proposed Pilot Area 11

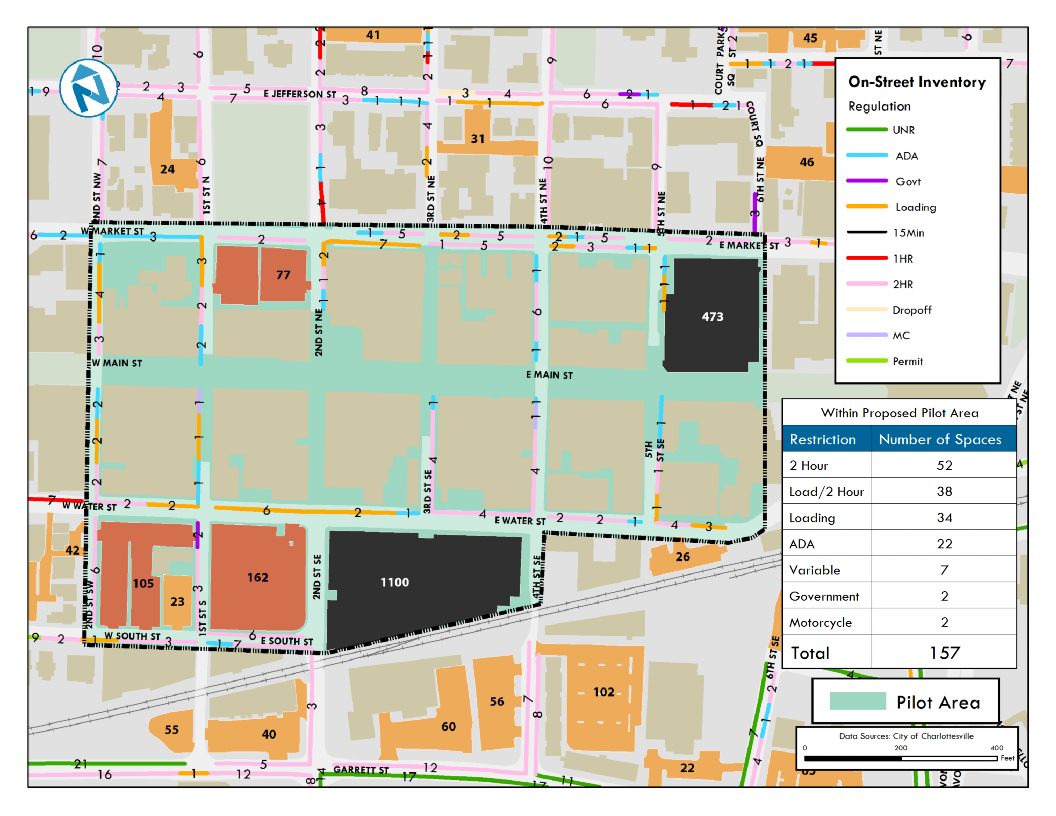

Figure 3 Inventory of Space Restrictions Inside the Proposed Pilot Area 11

Figure 4 Proposed Pilot Area Weekday Utilization 12

Figure 5 On-Street Parking Management Summary 13

Figure 6 Example Progressive Pricing Comparison 14

Figure 7 Simplified Net Revenue Projections 14

Figure 8 Pilot and Affected Areas 15

Figure 9 Inventory of On-Street Restrictions in Close Proximity to the Proposed Pilot Area 16

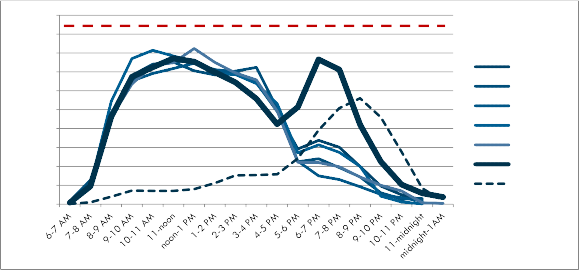

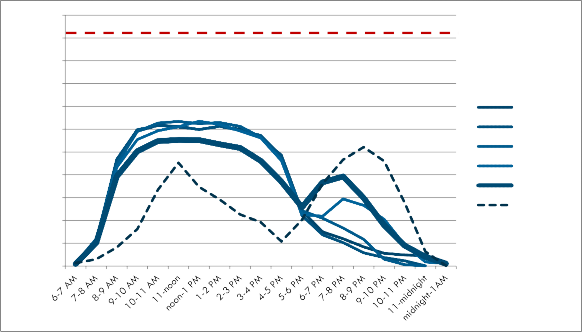

Figure 10 Roanoke Observed Utilization Rates 27

Figure 11 Roanoke Observed Weekday Utilization 28

Figure 12 City of Dallas Contracts its Back Office Operations 34

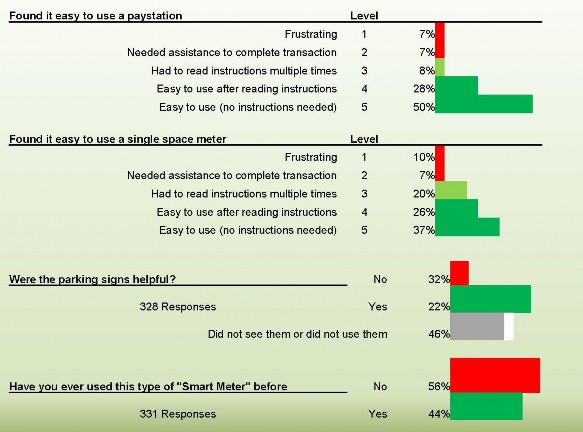

Figure 13 Results from Customer Surveys for Dallas Meter/Sensor Pilot 39

Pilot Area Map with On-Street Restriction Count 43

Market Street Garage Utilization Profile 44

Water Street Parking Garage Utilization Profile 45

Downtown Cultural Zone Weekday Utilization Table 46

Downtown Cultural Zone Weekday Turnover Table 47

Downtown Cultural Zone Saturday Utilization Table 48

Downtown Cultural Zone Saturday Turnover Table 48

Downtown Government Zone Weekday Utilization Table 49

Downtown Government Zone Weekday Turnover Table 49

Downtown Government Zone Saturday Utilization Table 50

Downtown Government Zone Saturday Turnover Table 50

Downtown Market Zone Weekday Utilization Table 51

Downtown Market Zone Weekday Turnover Table 51

Downtown Market Zone Saturday Utilization Table 52

Downtown Market Zone Saturday Turnover Table 52

Downtown Southeast Zone Weekday Utilization Table 53

Downtown Southeast Zone Weekday Turnover Table 53

Downtown Southeast Zone Saturday Utilization Table 54

Downtown Southeast Zone Saturday Turnover Table 54

Following on the 2015 Downtown and University Corner Comprehensive Parking Study, the City of Charlottesville has fast-tracked a complementary set of pricing-based management strategies for implementation, via a priced-parking pilot. This document outlines the specifics of attempting to implement such a program along with recommendations specific to Charlottesville.

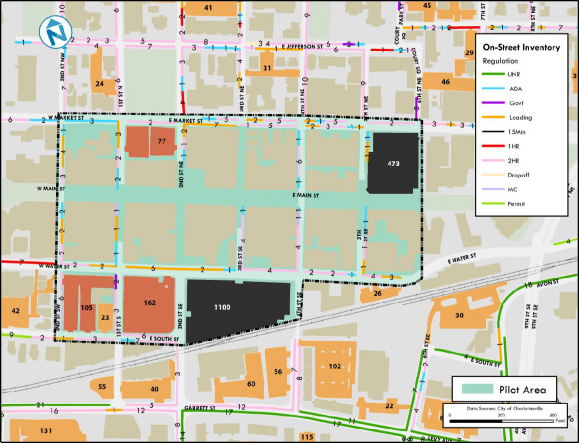

The proposed pilot area is bounded by 2nd Street (West), Market Street (North), 6th Street (East), and either South Street or the railroad tracks (South) and includes 157 on-street parking spaces. Of these, 97 are currently regulated as 2-Hour spaces at most times of day. The selected pilot area surrounds the pedestrian mall as well as new development sites, and includes those spaces most proximate to retail destinations, which are expected to benefit from improved turnover and space-availability. The two major downtown parking structures are also located within the boundaries, facilitating strategic, coordinated management between on- and off-street parking options.

Metered spaces should be priced at $2 per hour, payable in 15-minute/50-cent increments. The meter-enforcement schedule should extend to 8PM to allow pricing to continue to maintain availability in service to evening-peak destinations. Further consideration should be given to on and off-street price points to better balance utilization as well as appropriate purpose use. A 30- minute free period is also recommended to serve as a customer-convenience policy for very short- term parking needs. This allows short-trip patrons to not pay the meter as they quickly come and go. Time limits may be retained on metered on-street spaces in order to reinforce the notion of premium short-term facilities. In the case of the Charlottesville pilot area, it is recommended to continue enforcing a two-hour time limit on the newly metered spaces.

While monitoring the pilot area during the pilot program, it will also be important to monitor, evaluate, and understand the new parking situation in likely spillover areas. The blocks surrounding the pilot area contain a significant unpaid parking capacity. In addition to 400 private spaces, the nearby blocks contain 294 publicly accessible on-street spaces. Over two- thirds of these (199) are time limited to two hours.

It may be necessary to conduct parallel small-scale parking studies during the pilot period to acquire updated information that takes the new pricing structure and its impact on motorist behavior into account. In the short-term, the City may consider applying time limits to High and Garrett Streets in an attempt to change the balance of 2-hour vs. unrestricted spaces in the immediate impacted area. Occupancy and turnover should be re-evaluated in these areas during the pilot period.

It will be important during the pilot program that enforcement activity both active and even across both the pilot area and immediately proximate impacted areas. Proper enforcement should not only improve the availability of facilities, but also improve the quality of data collected during the pilot program for determining its efficacy.

It is now common practice for cities and municipal parking managers to request a no-cost pilot period partnership with meter vendors. This reduces the requestor’s start-up costs and risk exposure in RFPs released for new meters and/or meter upgrades. This is recommended for Charlottesville as the best means of making final selections for meter vendor, meter models, features, and accessory equipment options. Using the RFP process to establish a vested partnership with a selected vendor, or set of “short listed” vendors, will provide essential support for pilot launch, and also ensure ongoing vendor support in performance monitoring, troubleshooting, customer-service, marketing and information throughout the pilot period.

The pilot period should run for several months, and cover a change in seasonal activity, beginning in a normative or “slow” month, but covering at least one month when activity is normative and at least one “busy” month, the latter occurring after a few months have passed, to allow drivers to build familiarity and for managers to work with the vendor/s to sort out the inevitable glitches before demand pressures peak. For Charlottesville’s needs, which include the introduction of pricing among previously free parking spaces, a six-month period is recommended.

The City should request proposals from vendors that focus on “smart” single-space meters, multispace “pay by space” kiosks, or a combination of both. Given that on-street parking in the proposed pilot area is already striped, a “pay and display” system is not recommended.

Minimum system features for the new parking meters include accommodation of credit-card payment and seamless coordination with a mobile payment option (pay by phone). Both of these options provide a transformational change in how drivers respond to parking options and their cost. The convenience each adds to the payment process facilitates compliance and reduces resistance to higher parking rates.

From a management perspective, minimum meter/system features should include the capacity to quickly, easily, and cost-effectively adjust rates in response to demand/availability, and to potentially charge escalating rates for longer stays, as well as full compatibility with hand-held enforcement units.

The proposed pilot presents an opportunity to reframe parking rates as focused on performance, and to reframe parking as but one means of accommodating mobility and access to downtown businesses. The City should make the best use of this opportunity to establish a new position, to serve as the City’s downtown parking and mobility manager.

Adopting pricing as the primary management tool for Charlottesville’s public parking resources provides an opportunity to evaluate the organization of the City’s current parking management authority and activities. The City should identify its proposed organizational structure for managing the parking system, including any necessary coordination between distinct City departments/agencies and any expected outsourcing to management firms, within the RFP. This should include elements that represent a change from the current structure. Within the scope, the City should request prospective vendors to identify means by which they will assist with staff

training, coordination strategies, and process-development to facilitate these structural adjustments, and prepare for a seamless transition to post-pilot ownership of the system.

Parking enforcement should be focused on helping the City achieve the performance measures outlined for the pilot and the overall parking program. Each fine has to be high enough to prevent the abuse of short-term spaces, without being overly punitive of innocent mistakes. This can be addressed by simply increasing the fine level for repeated violations, so that they quickly become too high to be ignored.

First-time violations should incur only a "courtesy" ticket (no fine), that includes detailed information on parking options, pricing, and regulations, as well as information on the escalating fine schedule for repeat violations. This emphasizes that parking enforcement is really about managing access to public resources. This also formally adds an information-providing role for enforcement officers, altering their relationship with the parking public.

The value of the pilot is to assess the impact of metering parking in the downtown and to make course corrections before deploying the strategy citywide. To this end, it is important to define measures of success and the methodology for collecting and evaluating data. The cost effectiveness, accuracy, and reliability of proposed data-capture technologies/processes should be a central focus for the City. Of particular concern should be the capacity for the City’s proposed parking-management staff and organizational structure to continue processes and analysis established during the pilot.

Additionally, the proposed pilot period will provide an opportunity for the City to evaluate, in real time and place, several aspects of the technologies being considered, before making a final investment. Related to this investment, the pilot will allow the City to assess their operational and maintenance costs, in action and in context, and to explore any cost-reduction opportunities with the vendor.

The RFP for the pilot program should state that prospective vendors must identify how they will assist the City in the evaluation of the performance of the technology involved, including all technologies related to the meters, accessory elements, and back-office support.

Any technology-based data collection process will be developed in coordination with the vendor selected for the pilot. Some manual data collection will also be necessary, if not within the pilot area then in the surrounding areas and off-street facilities. The City should also identify expectations in the RFP that the selected vendor will work with the City to develop/refine manual data-collection processes as necessary to evaluate pilot performance.

2015 COMPREHENSIVE PARKING STUDY

In 2015, a parking utilization, turnover, and public outreach study was performed to recommend a course of action to improve parking and access to support a vibrant and vital downtown for the diverse range of workers, visitors, and patrons in the city. This work built upon, updated, and reassessed the recommendations of a similar study completed in 2008.The new study was a data- driven process that identified opportunities for change, innovative alternative management, and pathways to accommodate existing development and future growth. The findings of this effort, in tandem with those produced by the 2014 West Main Street Parking Opportunities and Analysis, yield a complete picture of parking conditions and opportunities along the entirety of Charlottesville’s major commercial, educational, and mobility core.

Critical needs, identified via quantified supply and demand conditions as well as input from a broad range of parking stakeholders, are summarized below.

Parking and access for downtown workers. Many downtown employees drive to work and many of them cannot afford the price to park daily in off street facilities. A significant portion of downtown workers can and would commute via an alternate mode if it were convenient and compelling to do so. When they must drive and park, however, workers need affordable accommodation that does not require the “2-hour shuffle.”

Available parking for commercial patrons. Charlottesville is a destination. Continued strength of the commercial establishments and entertainment venues means that parking must be easy to access, reliably available, and convenient to use for visitors and patrons.

Accommodation of court functions. As a municipality and county seat, Charlottesville sees a dramatic rise in parking demand on court days. Charlottesville must have ready solutions to address court needs to efficiently serve this judiciary function.

Maintenance of neighborhood quality of life. Charlottesville is a living downtown. Residents live above and adjacent to shops and commercial destinations. While strong commercial support is required, parking management must also be cognizant of neighborhood quality of life and minimize spill over parking pressures.

Access and circulation. Parking is only part of the downtown picture. Curbsides are also needed to drop off patrons, students or other passengers; short term loading and deliveries; and efficient circulation in the downtown that minimizes congestion and other negative environmental, economic and community effects.

Accommodation of growth and change. Charlottesville is fortunate to remain a growing economy. However, in some instances, growth means the conversion of existing parking resources. The city must plan to manage and meet parking, access and circulation demand that accompanies this new growth and adapts to changing resource supply.

Efficient and coordinated management of resources. Charlottesville must optimize resources to make parking and access convenient, efficient and understandable.

After thoroughly reviewing collected data and gaining insight from a diversity of users and stakeholders, recommendations were made to address critical needs. These can generally be grouped into three broad strategies, as outlined below.

At present, existing parking resources are not being optimized, creating perceptions of scarcity that could be addressed through management at a fraction of the cost adding parking. While some parking resources are over-subscribed, others show available capacity that could be better used.

Establish a City Parking Department. As in 2008, a City Parking Department remains necessary to more holistically and responsively manage parking to the benefit of businesses, visitors, and residents.

Adopt demand-responsive management for on- and off-street resources.

Meter the Highest Demand On-Street Parking. This generally applies to the core of the downtown and main commercial corridor of University Corner.

Right-size Off-Street Parking Fees. In general, on-street parking is more desirable than off-street parking thus demand responsive pricing would indicate that off-street parking fees should be lower than on-street rates.

Maintain Some Free Parking. Several areas of downtown have comparatively low demand for parking and should, at present, remain a free parking resource.

Revisit Regulations.

Remove or ease time limits, especially in areas where meters will be adopted.

Align times and durations of regulations with periods of demand.

Re-examine areas of special reservation of curbsides for where these uses can be better served in off street locations or through new management strategies.

Make Parking Easy. Utilize available parking technologies to make parking easy including finding available spaces, extending time remotely, and permitting payment via a variety of mechanisms.

Improve and equalize enforcement. Management strategies, and the establishment of a new department, should facilitate enforcement across all zones.

Create Parking Benefit District(s). Similar to recommendations from 2008, parking revenues should be dedicated to one or more parking benefit districts to support parking facilities and management, arrange shared parking, improve information, and implement transportation demand management.

Transportation Demand Management offers information and incentives that help make alternatives to driving and parking rational choices for users.

Design and Implement a Transportation Demand Management Program / Establish a Transportation Management Association. The Parking Department could, more broadly, be referred to as a “Mobility” Department to ensure that promotion of a broad range of access to the downtown and across the city were also part of the charge of this new department.

Enable, promote, and encourage the continued expansion of alternative mobility options. As each new mobility option appears, the set of methods employed to slow or reverse parking demand becomes larger. These may include the addition of low-stress bicycle facilities and adequate bicycle parking, enhanced transit operations and services, bicycle and car sharing systems, and other similar services.

Current parking levels should be maintained, but continuously monitored and evaluated.

Maintain existing parking requirements for new development. Similarly the current “in lieu” payment option should remain for those properties unable to provide parking on site or desiring to participate in a shared arrangement.

Strategically expand where opportunities present themselves

Partner in parking replacement or enhancement. Engage in shared parking arrangements to better use surplus off-street capacity in private downtown lots.

Participate in development to integrate new public parking spaces into development projects, in lieu of private/accessory spaces.

The City has fast-tracked a complementary set of pricing-based management strategies for implementation, via a priced-parking pilot. The remainder of this document outlines the specifics of the proposed pilot for an on-street parking pricing program, addressing all elements within recommendations 2, 3, and 4 above.

This pilot overview and a recommended implementation approach are organized as follows.

Pilot Parking Pricing Area

Proposed Pilot Area, Targeted Current Conditions, Operational Proposal

Impact Mitigation

Spillover Management

Implementation Strategy

Evaluation of System Alternatives

Implementation Strategy, TimeFrame, Choice of System, System Features, Vendor Options

Peer Profile: Roanoke, Virginia

Organizational Options, Performance-Focused Enforcement, Changes in City Code

Performance Measurement

Pilot Performance Criteria, Pilot timeframe, Evaluation Metrics, Data collection process

Figure 1 Weekday Downtown Parking Demand, April 2015

The proposed pilot area shown in Figure 2 is bounded by 2nd Street (West), Market Street (North), 6th Street (East), and either South Street or the railroad tracks (South) and includes parking spaces located along both curb-faces of those streets (Figure 2). Despite higher occupancy in other portions of the original study area, the selected pilot area surrounds the pedestrian mall as well as new development sites, and includes those spaces most proximate to retail destinations, which are expected to benefit from improved turnover and space-availability. The two major downtown parking structures are also located within the boundaries, facilitating strategic, coordinated management between on- and off-street parking options.

The proposed pilot area contains 157 on-street parking spaces. Of these, 97 are currently regulated as 2-Hour spaces at most times of the day (Figure 3). Spaces described as ‘Load/2 Hour’ refer to spaces which function as a loading zone or trash pickup area at certain times of the day, usually before 11AM. ‘Variable’ spaces are a subset located on the south side of Market Street between 2nd and 3rd Streets NE. These spaces are currently regulated by hinged signs and can be toggled between 2 Hour and Loading restrictions dependent on the needs of the adjacent Paramount Theater.

Figure 3 Inventory of Space Restrictions Inside the Proposed Pilot Area

Restriction | Number of Spaces |

2 Hour | 52 |

Load/2 Hour | 38 |

Loading | 34 |

ADA | 22 |

Variable | 7 |

Government | 2 |

Motorcycle | 2 |

Total | 157 |

The pilot program also offers an opportunity to reassess these restrictions and reallocate spaces for special needs (ADA, Motorcycle, Bicycle, etc.). Restriction terminology is described in further detail in the parking restriction glossary included in the Appendix.

The proposed pilot area attracts elevated occupancy within two-hour spaces (Figure 4). Availability is constrained (less than 15% of supply) within this critical parking supply for much of the day – see cells highlighted in red below.

Figure 4 Proposed Pilot Area Weekday Utilization

Utilization Rates: Proposed Pilot Pricing Area Wednesday, April 22, 2015 | |||||

On-Street | |||||

2 Hour | Load/2HR | ADA | All Other Restrictions | Total, All Restrictions | |

Capacity | 59 | 36 | 20 | 36 | 151* |

8 AM | 59% | 42% | 20% | 31% | 43% |

9 AM | 83% | 50% | 40% | 47% | 61% |

10 AM | 88% | 78% | 45% | 50% | 71% |

11 AM | 88% | 78% | 45% | 47% | 70% |

12 PM | 93% | 83% | 60% | 50% | 76% |

1 PM | 86% | 83% | 55% | 47% | 72% |

2 PM | 73% | 69% | 30% | 69% | 66% |

3 PM | 69% | 36% | 15% | 67% | 54% |

4 PM | 71% | 42% | 30% | 64% | 57% |

5 PM | 81% | 36% | 15% | 75% | 60% |

6 PM | 80% | 64% | 50% | 69% | 70% |

7 PM | 78% | 58% | 45% | 72% | 68% |

*Statistical analysis shows 151 total spaces rather than 157 due to construction-related temporary closures.

On-street, parking should be managed using tiered pricing: the highest priced parking should be on the blocks with greatest demand, lower pricing on blocks with modest demand, and free in the areas of little to no demand to incentivize the most efficient utilization of the existing parking resources. This helps to achieve parking availability goals in the most convenient “front door” curb parking spaces. The pilot will initiate this approach, by pricing many of downtown’s most convenient spaces, which should create more availability among these spaces, and encourage broader use of all available parking resources.

Metered spaces should be priced at $2 per hour, payable in 15-minute/50-cent increments. The meter-enforcement schedule should extend to 8PM to allow pricing to continue to maintain availability in service to evening-peak destinations.

Figure 5 On-Street Parking Management Summary

Location | Price | Time Limit | # of Spaces | Free Period | Days of Week | Daily Span |

Today | ||||||

Entire Downtown | Free | Various, Mostly 2 Hour | ~450 Time Limited ~400 Unrestricted | Unlimited | Mon-Sat | 8AM-6PM |

Proposed | ||||||

Pilot Area | $2.00/hr | 2 Hours | ~100 | 30 Minutes | Mon-Sat | 8AM-8PM |

Remainder | Free | Various, Mostly 2 Hour | ~750 Non-Special Use | Unlimited | Mon-Sat | 8AM-6PM |

This pricing structure is proposed in tandem with a re-consideration of the current garage rates. Presently, a non-permit holder at the Market Street Garage pays $1.25 for the first half hour,

$2.50 per hour, and a daily maximum of $20.00. At the larger Water Street Garage the hourly rate is $2.00 with a $16.00 daily maximum. Further consideration should be given to on and off- street price points to better balance utilization as well as appropriate purpose use. Generally the on-street spaces are priced higher than their structured counterparts, but other methods exist to affect the utilization relationship as will be discussed in subsequent sections of this document.

A 30-minute free period is also recommended to serve as a customer-convenience policy for very short-term parking needs. This allows short-trip patrons (such as those dropping off a book, paying bills, picking up prescriptions, etc.) to not pay the meter as they quickly come and go.

Most of the pilot area is presently regulated by two-hour time limits, which often restrict the viability of on-street parking options for many visitor needs. As the number of gathering spaces increases, customer and visitor length of stays are increasing. It is desirable to be sensitive to the needs of these patrons while simultaneously steering them toward off-street locations as a longer- term parking option. If adjustments are not made to garage pricing to make the desired long duration options more financially attractive, time limits may be retained on metered on-street spaces in order to reinforce the notion of premium short-term facilities. In the case of the Charlottesville pilot area, it is recommended to continue enforcing a two-hour time limit on the newly metered spaces.

Progressive pricing schemes present another means of encouraging turnover without setting hard cap on parking durations. In this scheme, the cost per unit time increases as time increases. For instance the first hour may cost $2, but the rate may increase $0.50 per hour during each

additional hour of use. A scenario is demonstrated in Figure 6 that makes garages a financially more attractive option than an on-street space without lowering the garage rates.

Figure 6 Example Progressive Pricing Comparison

Parking Time | On-Street Progressive | Market Street Garage | Water Street Garage |

First Hour | $2.00 | $2.50 | $2.00 |

Second Hour | $2.50 | $2.50 | $2.00 |

Third Hour | $3.00 | $2.50 | $2.00 |

Fourth Hour | $3.50 | $2.50 | $2.00 |

Total Cost | $11.00 | $10.00 | $8.00 |

In an effort to understand the basic revenue generating capability of meters in the pilot area, a brief financial analysis was undertaken using occupancy figures from the prior comprehensive study. Assumptions include the proposed $2 per hour price point, 100 installed meters, occupancy discounted at an elasticity of 0.15 (TCRP Report 95). 2-hour stays consistent with area turnover data, 80% credit card use as witnessed in a similar program in Annapolis, Maryland, and a $0.27 credit card transaction fee as is charged by the SFMTA in San Francisco.

Bear in mind that the pilot program is designed to initially share revenue and pay down capital costs which are predicted to cost roughly $500 per meter. There will be other back-office costs such as software, administration, and enforcement, but it is important not to confuse broader recommendations for the establishment of a parking management department and demand management programs as limited by the revenue generating ability of the parking meter program.

Figure 7 Simplified Net Revenue Projections

Time | Observed Occupancy | Discounted Projected Occupancy | Hourly Revenue | Credit Processing Fees | Daily Net Revenue | Annual Net Revenue |

8AM | 53% | 45 | $90.10 | $9.73 | $80.37 | $24,351.87 |

9AM | 71% | 60 | $120.70 | $3.30 | $117.40 | $35,570.75 |

10AM | 84% | 71 | $142.80 | $12.12 | $130.68 | $39,596.77 |

11AM | 84% | 71 | $142.80 | $13.04 | $129.76 | $39.318.61 |

12PM | 89% | 76 | $151.30 | $15.42 | $135.88 | $41,170.91 |

1PM | 85% | 72 | $144.50 | $15.42 | $129.08 | $39,110.51 |

2PM | 72% | 61 | $122.40 | $13.18 | $109.22 | $33,094.87 |

3PM | 57% | 48 | $96.90 | $10.37 | $86.53 | $26,219.20 |

4PM | 60% | 51 | $102.00 | $11.02 | $90.98 | $27,568.15 |

5PM | 64% | 54 | $108.80 | $10.47 | $98.33 | $29,795.44 |

6PM | 74% | 63 | $125.80 | $11.02 | $114.78 | $34,779.55 |

7PM | 71% | 60 | $120.70 | $11.75 | $108.95 | $33,011.73 |

Totals | $1,468.80 | $136.83 | $1,331.97 | $403,588.36 |

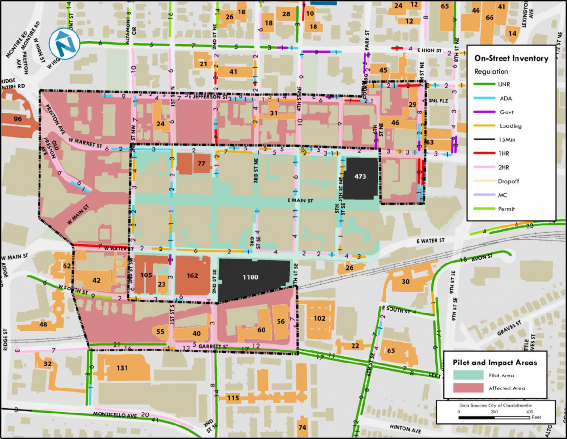

As changes are made to on-street parking typology and pricing, adjacent areas will begin to see different utilization patterns. As shown in Figure 8 and tabulated in Figure 9, the blocks surrounding the pilot area contain a significant unpaid parking capacity. In addition to 383 private off-street spaces and 17 inaccessible on-street spaces (9 Permit, 8 Government), the nearby blocks contain 294 publicly accessible on-street spaces. Over two-thirds of these (199) are time limited to two hours. A major component of the pilot pricing strategy will be the management of these adjacent free areas.

Figure 8 Pilot and Affected Areas

Figure 9 Inventory of On-Street Restrictions in Close Proximity to the Proposed Pilot Area

Restriction | Number of Spaces |

2 Hour | 199 |

Unrestricted | 38 |

1 Hour | 26 |

ADA | 20 |

Permit | 9 |

Loading | 8 |

Government | 8 |

Dropoff | 3 |

Private Total | 17 |

Public Total | 294 |

Three foreseen projects will have an effect on the overall downtown parking supply. The Levy Lot, located on Market Street between 7th and 8th Streets NE is slated for redevelopment by the housing authority. This lot is currently used for city employee parking and provides 63 private off-street spaces (permit required, no daily sale of parking to the public) in the Government Zone.

A reconstruction of the Belmont Bridge carrying 9th Street SE over the railroad will remove approximately 50 unregulated parking spaces beneath one of its spans. This lot was outside of the study boundaries and not included in the off-street inventory of this study, however it is important to note the pending loss of these spaces.

Finally, the Market Plaza proposal will replace and redevelop the existing parking lot at Water and First Streets. After a three year disruption, 102 of the existing 105 public parking spaces will be restored. The City Market will continue to operate on Saturday mornings in the only remaining publicly available surface lot in the Market Zone until the development is completed.

While monitoring the pilot area during the pilot program, it will also be important to monitor, evaluate, and understand the new parking situation in likely spillover areas. There are many aspects of spillover behavior that should be understood in order to develop an appropriate response.

Temporal characteristics of the spillover condition (When does spillover occur?)

Identification and quantification of destinations that are attracting the extra vehicles

Quantification of designated parking capacity and utilization for major destinations

Parking regulations in spillover areas

Availability of nearby public and/or private inventory suited to handling overflow

It may be necessary to conduct parallel small-scale parking studies during the pilot period to acquire updated information that takes the new pricing structure and its impact on motorist behavior into account.

As summarized in the form of official recommendations in the 2015 Comprehensive Parking Analysis, Effective management is the best and most cost-effective way to optimize parking supply and can have the effect of increased parking availability and better access to downtown employment and destinations.

The establishment of a Transportation Management Association can help to disseminate information about alternative commuting options, run events and campaigns to encourage workers to try alterative commutes, and develop tailored programs for both employers and employees that meet their needs. TMAs have demonstrated the ability to positively and substantially increase the awareness and use of alternative commuting options and increase worker satisfaction while decreasing household transportation costs. Easily identifiable establishments generating spillover parking should be encouraged to participate in such a program.

Remote parking for employees should be developed and encouraged. This arrangement would use available parking spaces at the edges or outside of Downtown where demand is lower and parking spaces may be underutilized. The remote parking would need to be tied into the existing trolley service or provided with a separate shuttle service to employment centers in downtown. This approach would reduce long-term parking demand from employees for spaces closer to Downtown and would also provide employees with either free or low-cost all-day parking.

As observed in the previous study, there are surplus off-street parking resources downtown, however many of these empty spaces are not available to the general public. Shared parking arrangements and lease agreements to make use of existing underutilized spaces at different times during the day can help address unmet parking demand.

Current restrictions on the duration of parking are misaligned with need and create localized parking shortages at certain times of the day. There are significant numbers of unrestricted spaces characterized by very low turnover rates just three blocks north and south of Main Street along High and Garrett Streets which are likely to see increased demand upon the implementation of an on-street pricing program.

The City should consider following the recommendations of the Technical Appendix associated with the 2015 study which would apply time limits to High and Garrett Streets in an attempt to change the balance of 2-hour vs. unrestricted spaces in the immediate impacted area. Occupancy and turnover should be re-evaluated in these areas during the pilot period.

After careful study, the City should also consider expanding the residential permit program where appropriate. Groups of residents should have the right to petition for inclusion in order to ensure that residents can find parking on their blocks.

Enforcement of time limits, no-parking areas, and permitted parking areas is in important tool in managing parking facilities in spillover conditions. According to the Comprehensive Parking Analysis report there was a significant imbalance in violations between the area north of Main Street compared to blocks south. Motorists were over three times as likely to receive a ticket in

the Cultural and Government Zones than in the Market or Southeast zones. Some of this observation may be attributed to the distribution of restrictions in the various zones.

It will be important during a pilot program in the core, and in the event that restrictions are modified south of the railroad tracks, that enforcement activity be both active and even across both the pilot area and immediately proximate impacted areas. Proper enforcement should not only improve the availability of facilities, but also improve the quality of data collected during the pilot program for determining its efficacy.

As discussed in the operational proposal and when possible, the City should restructure parking fees to better align parking price with parking demand and comparative value. Off-street spaces should ideally be priced lower than the hourly rate of the more valuable curbside spaces proximate to major destinations. The transient rates for both on and off-street spaces should be priced in response to demand – if there is an excess of unused off-street parking, pricing should be reduced. Likewise, when demand is high, the most important consideration in the determination of parking rates should be to maintain some availability on each block face at all times.

EVALUATION OF SYSTEM ALTERNATIVES

The team will prepare performance specifications for the City to utilize in discussions with technology and system providers. These specifications will include how the city would like to utilize metering technology (dynamic pricing or static; etc) and the data desired (space utilization sensors, or something less specific). Nelson/Nygaard will prepare an order-of-magnitude cost assessment to compare different system alternatives to cover the pilot area and future expansion areas. We will also provide a discussion of different management, maintenance and operational structures including contract or vendor service options.

A few years ago, meter vendors began offering to partner with cities and municipal parking managers in piloting their products, for free. This offer arose out of the vendors’ confidence in the revenue potential of their products, particularly when implemented where parking had been either free or priced via standard, coin-operated meters. Today, it is becoming a common practice to request this implementation step, which reduces the requestor’s start-up costs and risk exposure, in RFPs released for new meters and/or meter upgrades.

This is recommended for Charlottesville as the best means of making final selections for meter vendor, meter models and features, accessory equipment options, etc.. For example, the City of Roanoke’s 2015 RFP requested vendors to “provide details of their proposed pilot program inclusive of the number of meters needed, time frame for the pilot program, costs, a list of typical pilot objectives and tools available to measure pilot success including their version of a public information campaign that the firm has used in other successful pilots. Vendors should provide examples of any promotions or promotional materials for the pilot program.”

Using the RFP process to establish a vested partnership with a selected vendor, or set of “short listed” vendors, will provide essential support for pilot launch, and also ensure ongoing vendor support in performance monitoring, troubleshooting, customer-service, marketing and information throughout the pilot period. To this end, several RFPs that outline this implementation approach have been reviewed, along with other summary materials of pilot experience and outcomes, to identify common and recommended elements to inform a Charlottesville RFP.

The pilot period should run for several months, and cover a change in seasonal activity, beginning in a normative or “slow” month, but covering at least one month when activity is normative and at least one “busy” month, the latter occurring after a few months have passed, to allow drivers to

build familiarity and for managers to work with the vendor/s to sort out the inevitable glitches before demand pressures peak.

A review of RFPs issued for such pilots indicates that most cities opt for three- or six-month pilot periods. Many of these cities, however, have long had metered parking, and are simply testing out meter replacement options. Furthermore, several cities have experienced delays related to systems, technology, or communications issues that required shorter pilots to be extended.1 For Charlottesville’s needs, which include the introduction of pricing among previously free parking spaces, a six-month period that covers summer and winter months is recommended.

The City should request proposals from vendors that focus on “smart” single-space meters, multispace “pay by space” kiosks, or a combination of both. Given that on-street parking in the proposed pilot area is already striped, a “pay and display” system is not recommended. Such a system can increase curbside-parking capacities, if spaces are not marked, but are widely viewed as less “customer friendly” than pay-by-space systems.

For several years, multispace meters were the only option for Cities desiring complex features such credit-card payments and flexible pricing capacities. Today, several single-space meter models offer the same functionality as multispace meters, rendering the choice between the two less substantial from a management perspective. Similarly, today, multispace meters are designed to be able to function as “pay and display”, “pay by space”, or “pay by plate”, including the option to change between the options over time. The details of these options, as currently available, are summarized below, to help the City evaluate their pros and cons.

Multispace pay-station technology provides several potential advantages over traditional, single- space meters, including:

Reduced visual clutter as a single pay station can replace 8-10 traditional meters;

Expanded payment options, including smart card, credit card, and paper bills;

Expanded data collection and distribution options; and

Expanded options to increase revenue, compliance rates, and enforcement efficiency.

Rather than paying for parking at a meter that is assigned specifically to a parking space, customers pay their parking fees at a pay station which can accept payments for some or all parking spaces in the area. One or two pay stations are typically located on each block and evenly distributed to reduce walking distances from parking spaces. Payments made at stations are connected to customer vehicles via one of three methods:

Each payment is recorded in conjunction with a stall-identification code entered by the customer to coincide with his or her stall;

A payment receipt is dispensed at the station to be placed on the dash of the parked vehicle; or

![]()

1 1 http://www.delawareonline.com/story/news/traffic/burke/2014/03/31/newark-extends-smart-parking-meter-test-program/7138129/

1 http://www.fox23.com/news/news/local/new-pilot-program-parking-meters-stopped-downtown-/nnbk9/

Each payment is recorded in conjunction with the license plate ID code of the customer's vehicle.

Enforcement of payment-compliance is handled in various ways with pay station technology, depending upon the specific payment system that is used in coordination with this technology. Specifics of enforcement are detailed for each payment system in the following section.

Pay-by-Space (PBS) systems utilize space identification codes to track customer payments across the on-street inventory. Typically, spaces are marked either directly via paint on the street, or through a series of posts located on the side-walk.

How it Works

When drivers park in a PBS space, they must note the identification code assigned to their space, proceed to the nearest pay station, and enter the code in conjunction with their payment. The system is capable of providing immediate payment information and interfaces with many other parking management technologies designed to internally monitor utilization patterns and externally broadcast real-time information on space availability.

Enforcement

There are two ways for Parking Enforcement Officers (PEO’s) to enforce Pay-by-Space meters:

The PEO links up to the system network or Pay-by-Space meter via wireless communication to verify if the occupied space is paid.

The PEO can also manually run a report through the Pay-by-Space meter that shows all paid versus unpaid parking stalls.

Key Elements

Makes use of tokens, coins, bills, stored value cards and credit cards

Transactions are completed at the Pay-by-Space meter, eliminating the need for the customer to return to their vehicle

Provides an excellent communication platform to obtain occupancy and payment information when dynamic real-time data is the primary goal

Interfaces with Pay-by-Cell transactions by working in conjunction with the main office database, eliminating the need for enforcement staff to carry extra hardware and accessories

Supports two-way communication to allow the operator to:

receive payment transaction and trouble alarm information

perform rate and time changes

provide real-time credit card transaction processing

Capable of operating utilizing solar power

The system can be networked so the parking customer may extend time from any of the Pay-by-Space meters, provided they know their parking stall number.

Potential Drawbacks

Because Pay-by-Space requires a parking stall number to be entered into the meter, all parking spaces will be required to be 20 feet in length, as outlined in the “Manual on Uniform Traffic Control Devices” (MUTCD). Not all vehicles require 20 feet, and because of this, the system is not capable of maximizing all available parking on a block.

Pay-by-space meters also require curbside parking stall numbers to identify each parking space. Given the area’s winter conditions, elevated markers from the sidewalk will be required. This adds to additional curbside clutter.

Often parking customers neglect to make note of the parking space number, and this is even more likely for a visitor, who is required to complete a parking transaction. The customer then has to make a return trip to their vehicle to obtain this information, often resulting in frustration with the experience.

Like Pay-by-Space meters, Pay-and-Display meters are usually installed one per block face. The key distinction from Pay-by-Space systems is that Pay-and-Display systems eliminate the need to mark or identify parking stalls by providing customers with a receipt of payment to display on the dash of their vehicle.

How it Works

After parking, the customer pays for a selected amount of parking time, and then displays the valid receipt on the dash of their vehicle. This provides proof of payment to the enforcement officers.

Enforcement

There is really only one efficient way to enforce Pay-and-Display meters, and that is on foot. The receipt, which acts as proof of payment, is displayed on the dash, and there is no way to electronically communicate payment information to enforcement staff.

Key Features

Makes use of tokens, coins, bills, stored value cards and credit cards

Supports two-way communication to allow the operator:

to receive payment transaction and trouble alarm information

to perform rate and time changes

to provide real-time credit card transaction processing

No need to stripe parking spaces or display space numbers. Receipts indicate proof of payment, not stalls, which can result in a 5 to 10% gain in parking spaces.

The same space can be sold multiple times in the same time period due to the user taking the time with them; any unused parking time is on the display receipt and not on the meter, increasing revenue potential

The customer benefits by being able use the same receipt in multiple parking spaces, provided the receipt is still valid, and the parking rates and restrictions are the same

In most cases, one unit can cover an entire block face.

Capable of operating by utilizing solar power

Potential Drawbacks

While Pay-and-Display is capable of live communication technology, because there is no assigned parking space or stall number required for this technology, the system is not capable of giving real-time occupancy data.

This system requires the user to return to their vehicle and place the purchased receipt on the dash after the transaction is complete.

Pay-by-cell does not interface with a Pay-and-Display meter, but still may be used as a payment option. A separate monitoring system is required to be used by the Parking Enforcement Officer.

Pay-by-Plate (PBP) systems are the newest and least used among pay station systems. Some cities are requesting information regarding this technology, and while there is interest, it is not a preferred technology.

How it Works

As with Pay-by-Space and Pay-and-Display, the pay station is typically located mid-block and covers multiple parking spaces. Once a parking customer parks and locates a meter, they enter their vehicle license plate identity. The plate identity is linked with a digital record of payment and recorded in a central database.

Enforcement

Enforcement of Pay-by-Plate does require some form of a live communication device in the field. This is normally done using live hand held units or Licenses Plate Recognition vehicles.

Key Elements

Makes use of tokens, coins, bills, stored value cards and credit cards

Supports two-way communication to allow the operator:

to receive payment transaction and trouble alarm information

to perform rate and time changes

No need to stripe parking spaces or display space numbers. Receipts indicate proof of payment, not stalls, which can result in a 5 to 10% gain in parking spaces.

Capable of operating by utilizing solar power

Pay-by-license is the only pay station technology, at this time that can be enforced using license-plate-recognition systems

Potential Drawbacks

The system does require the customer to enter the vehicle license plate number. For first time users and visitors this will require a significant learning curve as well as a very detailed marketing and education component.

While Pay-and-Display is capable of live communication technology, because there is no assigned parking space or stall number required for this technology, the system is not capable of giving real-time occupancy data.

If street sensor technology is required then 20 foot stripped parking stalls will be required.

Many of the capabilities and amenities that were once exclusive to Pay Station products are being offered in single-space, “smart meter” products. More expensive than a typical, single-space meter, but less expensive than a pay station, these meters essentially function as pay stations, while providing the payment-location convenience of a traditional meter. Another emerging advantage of these meters is the capacity to add “occupancy sensors” to the meter, providing real- time occupancy data at much lower costs compared to “in-street” sensor systems.

Key Elements

Makes use of tokens, coins, stored value cards and credit cards

The parking customer is not required to return to their vehicle to display a receipt.

Capable of operating on solar power

The meter is located at the parking stall, so there is no need for the customer to walk any distance to make a transaction.

Optional vehicle detection built into the meter.

Offers a reset mode. When a paid vehicle leaves, the meter will zero out remaining time.

Pay-by-Cell can still be used as a payment option

Retrofits into most existing meter housings/poles.

Potential Drawbacks

This system still requires a meter and pole at every parking stall.

Size limitations of coin canisters will keep current single space parking meter collection procedures and associated costs.

All parking spaces will be required to be 20 feet in length, as outlined in the “Manual on Uniform Traffic Control Devices” (MUTCD). Not all vehicles require 20 feet, and therefore, this system is not capable of maximizing all available parking on a block.

Each meter requires its own communication account, which results in an increased cost over pay station technology.

Minimum system features for the new parking meters include accommodation of credit-card payment and seamless coordination with a mobile payment option (pay by phone). Both of these options provide a transformational change in how drivers respond to parking options and their cost. The convenience each adds to the payment process facilitates compliance and reduces resistance to higher parking rates (critical to pricing curbs appropriately to maintain availability in high-demand areas).

From a management perspective, minimum meter/system features should include the capacity to quickly, easily, and cost-effectively adjust rates in response to demand/availability, and to potentially charge escalating rates for longer stays, as well as full compatibility with hand-held enforcement units.

Issuing an RFP also provides an opportunity to review vendors’ proposals for generating, collecting, and analyzing occupancy data, sufficient to inform future price-adjustment options.

Our ongoing analysis in Ann Arbor, Michigan is finding that drivers seek out, and pay twice as much to use, spaces with pay-by-space meters (payable by credit card), compared to standard, coin-operated meters; despite identical rates and time limits between the two options. Daytime utilization among pay-by-space spaces was nearly 100%, with significant capacity among standard-meter spaces. In evenings, when meter payment is not required, this gap closed nearly completely, indicating that these spaces are particularly appealing only when payment is necessary.

This bears out our experience that, once the $1/hour rate is surpassed, requiring coin payment becomes a considerable nuisance to drivers; and it is this inconvenience, not so much the higher rate, that drivers really resent. Because so many drivers simply won’t have the change, compliance rates, parking durations, and customer satisfaction levels will predictably decline. The pay-by- space machines in Ann Arbor, by contrast, not only accept credit card payments, but also offer a “one press” button to purchase the “Maximum Time”. The fact that these machines are generating twice the revenue per parking action, despite carrying the same rate and time limit as the standard meters, indicates that this button is a highly popular option, and that, among your most valued customers, convenience can significantly increase the perceived value of curbside parking.

Mobile payment options build upon the convenience of credit-card acceptance, and take it much further. With this option, drivers do not have to interact with (or find) a meter to pay for their parking, and can pay with a few taps on a phone while walking to their destination. Standard features of these systems also include sending alerts when payments or time limits are nearing expiration, and being able to add time to a meter from any location.

Conventional meters tend to require significant, and costly, labor time to establish changes to rates and time limits. Any modern meter offers an improvement on this, but some models are likely to outperform others in facilitating smooth, easy implementation of changes to parking rates, rate-structures, and time limits.

Similarly, any computer-based meter can accommodate duration-based rate structures, which may be a desirable alternative to time limits in discouraging long-term parking stays in prime parking locations. The capacity for this feature to be utilized, and periodically adjusted, should be identified as part of the minimum set of system features.

The City should identify coordination with enforcement technology as a minimum system feature for proposed meters, and as a performance focus for the pilot.

The evolution of occupancy-sensor technology has evolved rapidly over the last 10 years, and in some unexpected ways. In-street sensors, first implemented in large scale as part of the SFPark project in San Francisco, appear to be fading as a viable option for most cities. Not only has the cost of such a system remained burdensome, but the managers of SFPark, themselves, appear to be abandoning this technology as the project moves from its pilot phase to final implementation.

The early excitement over in-street sensors spurred meter vendors to develop alternatives, which can be packaged along with their meters, as a lower-cost/no-dig alternative for tracking on-street utilization/availability in real time. These products, however, have suffered many of the same reliability and accuracy issues as the in-street sensors. And, as the in-street models appear to be fading, meter vendors appear to be less anxious, at least for now, to promote their own sensors, telling one recent client of ours to “wait a bit” before considering adding them to the meters they were purchasing.

In this context, the best means of evaluating options for adding occupancy-sensor accessories is to include in the RFP for the pilot a list of data-collection needs, and asking each bidder to identify how they will work with the City to develop a process for achieving them, whether through technology or through manual-observation processes.

The smart-meter/pay-station market has matured greatly in recent years. There are currently several well-established meter vendors capable of meeting all of the specifications identified above, including the following.

T2

Cale

Digital Payment Technologies

Duncan

IPS

Parkeon

Siemens

Ventek

An effective RFP should return proposals from at least a few of these firms.

PEER PROFILE: ROANOKE, VIRGINIA The City of Roanoke recently gained valuable experience in implementing a pilot-based introduction of metered parking on downtown streets. Those involved in this process have shared the following information so that other cities contemplating a similar approach can benefit from their experiences. Background Downtown Roanoke benefits from a high level of walkability and a vibrant commercial core that offers a wide variety of retail, dining, entertainment, cultural, recreational, open-air market, and employment destinations. Adding to this is a growing downtown residential population. At its center is the City Market area, offering significant evening and events- based activity throughout the year. The City’s Parking System consists of ~4,000 on-street spaces and over 4,000 City-managed off-street spaces. On-street meters were removed in the 1990’s in hopes of stimulating downtown growth via the promotion of “free parking”. On-Street parking remains free today, while off-street options are priced. As the downtown economy and population has grown, frustration with parking has grown with it. Visitors and business owners have cited a lack of access to available short-term parking as a significant impediment to downtown’s growth and economic potential. At the same time, peak-hour surveys completed by the City and ParkRoanoke consistently found substantial short-term parking availability. | ||||||||

Inventory | Utilization | |||||||

On-Street Spaces | Weekday AM | Weekday Midday | Weekday PM | Saturday AM | ||||

1290 | 44.8% | 56.7% | 46.7% | 55.9% | ||||

In 2012, Nelson\Nygaard and the US EPA facilitated a two-day on-street management parking workshop for the City. The workshop format, activities, and supportive materials were developed for the EPA specifically to address this common gap between perceived parking supply deficits and measures that find supply surpluses. The workshop’s Audit surveys confirmed a significant surplus of physical parking capacity during weekly peak- demand conditions. The Audit, along with field observations did, however, reveal key conditions creating the perception that there was “nowhere to park” downtown. | ||||||||

Demand was concentrated in the downtown core, and along prime retail blocks. This typically results in a majority of drivers beginning their searches for parking along the same blocks, travelling common routes, with many giving up before exploring beyond these well-travelled corridors where availability was, in fact, ample.

The commitment to maintaining free on-street parking had led to a dominance of 1-hour parking restrictions on most downtown-core blocks. While this helped keep downtown commuters from using on-street spaces, it meant that these spaces simply were not viable for an increasing share of downtown visitors, who were not there to run errands but to spend time and experience the uniqueness of downtown.

Many customers noting a lack of parking options were found, in fact, to be expressing frustration that, while on-street parking was free, their parking needs required them to park in less-convenient off-street facilities, and pay.

Figure 11 Roanoke Observed Weekday Utilization

Following the workshop, the City decided to pursue pricing as the primary management tool for maintaining consistent availability among its curb spaces, and to expand time limits to make these spaces more viable for more downtown customers.

The next year, the City took its first major step toward implementing this decision when it issued a Request for Information (RFI) seeking information on technology options for returning meters to downtown. As noted in the RFI, the purpose of the RFI was “to solicit information… that will allow the City to evaluate available services, state of the art technology, and equipment for multi-space parking meters that may best meet the City’s needs.” Toward this end, the RFI requested that responding vendors include information on how they might provide the following components of a downtown metering program.

Supply, installation, implementation, operation, and maintenance of all necessary equipment for a metering program that is in compliance with all state and city ordinances.

Tracking and documenting space utilization.

Equipment features, including: weather resistance, vandalism resistance, interfaces with credit card processing, interfaces with smart phone applications, and power supply.

Training City staff to manage the system.

Information campaigns and/or training on how to use the system for the general public.

Synergy with management best practices.

Wireless capabilities.

Web-based solutions.

Self-hosting or vendor hosting options, including details on hardware and software needs for either option.

Details on any subcontracted elements, and subcontractor qualifications.

Descriptions of startup processes, pilot programs, testing and quality controls, the equipment and software used, including any ancillary technology requirements, personnel requirements, public information processes, suggested schedules, maintenance schedules, etc.

Coordination with license plate reader technology for enforcement.

Configuration for variable rates and for changes in rates, including rate changes over time.

Details on storage and archiving of data.

Sample reports provided by the software and/or hardware such as space turnover, parking duration, and other tracking mechanisms.

Details on security protocols over credit card, cellular telephone or other customer centric data.

Details on the useful life, maintenance routines, and warranties.

Following a thorough review of received responses from 10 distinct vendors, the City began preparing to develop a pilot to test the most promising meter and supportive-technology options, and to ease the transition to on-street pricing. For the pilot, the City decided to seek vendors willing to provide meters, at no cost to the City, to be evaluated for selection for a permanent program. Steps taken to prepare for the pilot include the following.

Adopting an ordinance allowing a pilot program

Adopting an ordinance allowing metering

Analyzing Information and Issuing a Request for Proposals

Develop a timeline for implementing the pilot

In May 2015, the City released its RFP for the meter pilot program, seeking “competitive proposals from qualified Offerors to provide installation and maintenance of electronic state of the art multi-space and single space parking meters…”. The RFP specified that before the City selected a vendor for the planned downtown parking meter program, it desired to “implement a pilot program, at no cost to the City, to evaluate parking meter solutions by deploying meters that are selected from this RFP process.” It further stated that any decision to expand the pilot to a full program “will rest on the results of the pilot program”. Similar to many cities that have releases similar RFP for meter pilots, the City of Roanoke reserved the right to “select multiple vendors for simultaneous or successive pilot programs and to award to any such vendor with the program deemed most advantageous to the City.”

Pilot Program

Provide details of a proposed pilot program including the number of meters needed, time frame for the pilot program, costs, a list of typical pilot objectives and tools available to measure pilot success

Proposal for a public information campaign, based on what the firm has used in other successful pilots.

Examples of any promotions or promotional materials for the pilot program.

Evaluation criteria, not limited to:

Ease of use by a range of customers.

Durability of the meters.

Ease of using various payment options.

Wi-Fi connectivity of the meters to the central parking office.

Connectivity to the City’s parking enforcement handheld devices.

Patron use patterns relative to meter placements.

Ease of use of “back office” software.

Effectiveness of system reporting capabilities.

Key Meter Standards

The City requested that all proposed meter be capable of:

Accepting credit, debit, smart cards, tokens, coins/bills and pay by phone payment options or other contactless payment options.

Performing consistently in variable local climate conditions.

Complete communication between meters types as well as communicating with the City’s hand-held ticketing devices and software.

Functioning in both a Pay by Space and Pay-By-Plate environment, without hardware change.

Minimizing “back-office” software required to administer meters and enforcement.

Working with the City’s established enforcement administration software system.

Being clearly read in any lighting, including nighttime.

Key Meter Housing Standards

The City requested that all meter-housing meet the following criteria.

The exterior should be constructed of high grade corrosion-resistant steel with a vandalism resistance surface.

The meter must operate without failure in the weather conditions experienced in

Roanoke, VA, including but not limited to: rain and temperatures between minus

10 degrees Fahrenheit to minus 25 degrees Fahrenheit and in excess of 100

degrees Fahrenheit and humidity up to 100%.

Easy cleaning and graffiti removal.

Separate compartments between maintenance and collection activities.

ADA compliant.

Reporting

The City identified a desire to “have a complete set of financial, technical, and audit reports from the back-office/management software.”

The following was requested of responses to allow the City to evaluate the qualifications of each firm.

Organizational structure of firm and qualifications of management personnel.

Financial condition of the firm and ability to perform all obligations of any resultant contract.

Experience in providing the services and/or items requested by this RFP.

The ability, capacity, and skill of the Offeror to provide the services

The quality and timeliness of performance of previous contracts

A description of the marketing approach and promotions proposed to maximize revenues generated from the services or items requested in this RFP, including examples of any promotions or promotional materials.

The City of Roanoke received proposals from five distinct vendors (T2, Hectronic, Cale, IPS, and Parkeon), and evaluated each, based on the criteria and objectives noted in its RFP. It selected a single vendor, with whom they began to plan a late-Spring pilot this past January. The City had considered, as some cities have done, including multiple vendors and/or meter types. Roanoke decided that the disadvantages of this approach were more significant than its advantages.

Including multiple vendors/meters would provide more flexibility and leverage to the City to negotiate pricing and terms at the final-selection stage, and allow it to get public feedback on more meter types/features. However, the City had been warned of the significant complications of a multi-vendor pilot.

“In th e lo ca liti es we ca lled /v isi ted fo r re fer ences, ma ny sa id bewa re of pilo ti ng sev era l types of meters all at the same time. You will never get out of that tangle and that is WAY too much choice for the average parker to navigate, or for a city to test all at the same

ti me.”

- ParkRoanoke

The prospect of managing multiple “back office” software systems was a particular concern that led the City to narrow their selection to a single vendor for its pilot. If they are not satisfied with the results, they can go back to review the proposals from other vendors and consider a follow-up pilot.

The City is working with its vendor, Parkeon, to prepare to launch the planned three-month meter pilot this June. One factor in selecting Parkeon was that they were the “most generous firm in their proposal as far as the number and variety of meters they were willing to place in

the field”. While the pilot will be provided at no cost to the City, and the City will retain all collected revenues during the pilot2, the City has agreed to provide labor and materials to pour the pads for and install all meter/kiosks.

Park Roanoke uses a private parking management company for its on- and off-street operations, and has begun conversations with this company about adjusting to a new model for on-street management/operations. ParkRoanoke expects to expand and retrain its enforcement officers, and will invest in license-plate readers as the pilot is rolled out.

Initial meter rates will be set at the prevailing hourly rate for ParkRoanoke’s off-street parking.

Know your downtown, and seek a group of the willing to support your effort.

We have had good participation from our downtown association (Downtown Roanoke3)

We have had an established Mobility work study group that has been involved with this, as well as many other improvements in the city.

That team provided support and took part in the RFI and RFP processes, which has been a plus.

The proposed pilot presents an opportunity to reframe parking rates as focused on performance, and to reframe parking as but one means of accommodating mobility and access to downtown businesses. The City should make the best use of this opportunity to establish a new position, to serve as the City’s downtown parking and mobility manager.

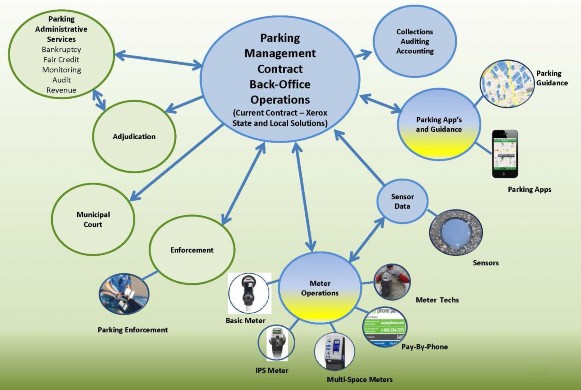

Adopting pricing as the primary management tool for Charlottesville’s public parking resources provides an opportunity to evaluate the organization of the City’s current parking management authority and activities. Organizational best practices are many and varied, but center on the concept of “vertical integration” of all parking functions. By default, the many components of parking management have tended to emerge and evolve within distinct, municipal departments, agencies, and authorities, in response to micro-level needs and objectives. Vertical integration, by contrast, typically requires refocusing attention on macro-level needs and objectives which are best served by a comprehensive parking management approach, preferable integrated into broader transportation and growth/development planning.

While full integration is rarely feasible, vertical integration should seek to place responsibility for as many of the following elements as possible under one City department or parking authority.

Off-street facilities

On-street resources, including curbside regulations and strategies, citywide

Overall program financial performance

![]()

2 Most meter vendors have come to accept providing free pilots as part of the cost of doing business and being competitive.

3 http://www.downtownroanoke.org/

Enforcement

Revenue collection and investment

System planning

Coordinated management of multimodal transportation, including demand- management/reduction efforts and programs

Parking system branding, marketing, and community outreach

Implementation of new technologies

Coordination with City land use, growth, and economic-development planners

Liaison with citywide business community, residential associations, and private parking providers/managers

Vertical integration can be achieved within a municipal department, or within a public authority. In either case, vertical integration can, and often does, include some level of outsourcing. Most commonly, a private parking management firm is hired to handle day-to-day operations and maintenance through a management contract. Through the management contract, the private parking management firm is paid a fixed management fee and/or a percentage of gross revenues and is reimbursed by the owner for all costs incurred in the operation.

Some cities have opted to hire a management firm to assume full responsibility for all aspects of parking management, through a concession agreement. Under such an agreement, the City concedes significant control over curbside management, typically for purposes of more efficiently monetizing its parking resources. Unless necessary to establish performance-based pricing, this is not an option we recommend to our clients.

The City should identify its proposed organizational structure for managing the parking system, including any necessary coordination between distinct City departments/agencies and any expected outsourcing to management firms, within the RFP. This should include elements that represent a change from the current structure. Within the scope, the City should request offerors to identify means by which they will assist with staff training, coordination strategies, and process-development to facilitate these structural adjustments, and prepare for a seamless transition to post-pilot ownership of the system.

Figure 12 City of Dallas Contracts its Back Office Operations

PERFORMANCE-FOCUSED ENFORCEMENT

The proposed pilot provides a unique opportunity to introduce innovative enforcement strategies that can help support the transition to paid parking in Charlottesville. Parking enforcement should be focused on helping the City achieve the performance measures outlined for the pilot and the overall parking program. Compliance is a critical means to these ends, but should not be viewed as an end in itself. As such, enforcement of basic pricing and regulation should be viewed as an extension of the parking management program.

A fixed table of fines for parking violations may be expedient for processing violations and payments, but it is ill-suited to serve performance-based parking management. Each fine under such a system has to be high enough to prevent the abuse of short-term spaces by those willing to pay dearly for the convenience they offer, without being overly punitive of innocent mistakes. This can be addressed by simply increasing the fine level for repeated violations, so that they quickly become too high to be ignored.

First-time violations should incur only a "courtesy" ticket (no fine), that includes detailed information on parking options, pricing, and regulations, as well as information on the escalating fine schedule for repeat violations. This emphasizes that parking enforcement is really about

managing access to public resources. This also formally adds an information-providing role for enforcement officers, altering their relationship with the parking public.

Combining this with incremental fines would look something like the following.

The first ticket in any 12-month period is does not incur a fine.

The violator is provided essential parking information, and directed to the City’s parking website

A second violation within 12 months would be fined at current, standard rates.

Subsequent violations would go up substantially, perhaps doubling.

Parking enforcement officers (PEOs) should be trained to notice when availability is lacking, and where it is ample, which should help them determine where to focus their efforts to best achieve more consistent availability.

Areas of consistently reduced availability — Areas where available spaces are consistently hard to find should become obvious to PEOs as they become more cognizant of their role in maintaining access to short-term spaces. Once recognized, these areas should receive priority attention throughout the day.

Areas of reduced availability in the early mornings — This is an indication of business owners and/or employees parking or loading from these spaces, as visitor parking demand is rarely significant before Noon (except outside coffee shops or similar morning- rush oriented businesses). This is not a problem in itself, and none of these vehicles will be in violation until after 10AM. But, if enforcement is lax in these areas, many of these vehicles will begin to overstay time limits, reducing availability for customers. If availability does not improve by 10AM, such blocks should be targeted for time-limit enforcement.

Areas of ample availability — Likewise, PEOs should become aware of areas where finding a space is rarely a problem, and de-prioritize these areas for enforcement. Consistently issuing tickets in low-demand environments sends the wrong signals about which objectives enforcement efforts are meant to serve. It also misallocates limited enforcement resources away from where they can provide the most benefit.

The Pilot should support and verify the merits of changes to the City Code that will be necessary for the City to continue to meter on-street parking, and to adjust meter rates based on documented utilization/availability conditions. Examples of City Codes that establish such authority, and outline the conditions-documentation and price-adjustment obligations and procedures, as recommended for Charlottesville are provided as appendices to this memo.

The value of the pilot is to assess the impact of metering parking in the downtown and to make course corrections before deploying the strategy citywide. To this end, it is important to define measures of success, the methodology for collecting and evaluating data, and defining the parameters of the pilot including duration of pilot period. Nelson\Nygaard will develop data collection protocols capable of working with a wide range of metering technologies without tremendous human capital requirements.